Over 11 years we have invested in and operated high-potential businesses in markets with historically low levels of client service and trust. This has given us untapped opportunities for disruption, innovation, and high returns. Our businesses leverage specialised knowledge, data and technology to deliver competitive solutions, benefiting clients and advancing their industries. They are led by a team of expert, entrepreneurial, and significantly co-invested professionals who relentlessly challenge the status quo to drive profitable growth.

Our group is connected by a common thread of entrepreneurship and integrity. This forms the foundation of our culture which filters into each of our businesses, giving us the ability to respond effectively and ethically to complex market dynamics. Merging this entrepreneurial drive with collaboration enables us to create net positive socio-economic returns with long-lasting shared value outcomes.

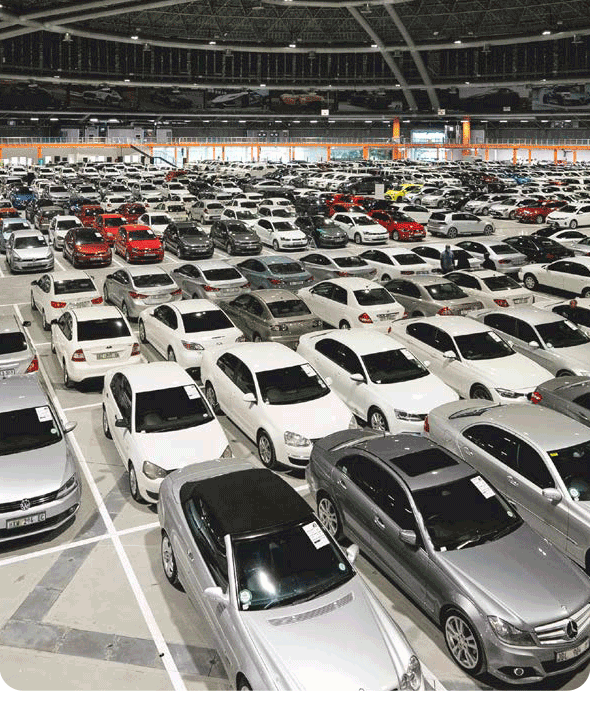

A trusted leader in second-hand vehicle trading with integrated online and physical platforms. WeBuyCars is recognised as the fasted and most convenient way to sell any vehicle in South Africa.

Uses unique technology, data and analytics to deliver digitally enabled business services to a global client base.

A comprehensive mobility platform providing access to minibus taxi ownership, financing, insurance, maintenance and related services. SA Taxi is a dedicated partner to the taxi industry.

Fulfills the need for finance and insurance solutions targeting older vehicles in the lower end of the second-hand vehicle market where traditional asset finance is not readily available.

Transaction Capital Ltd

3rd Floor

115 West Street

Sandton

South Africa

PO Box 41888

Craighall

2024

By providing your personal information you consent to the processing and sharing of your personal information with Transaction Capital Limited.© 2024 All Rights Reserved | Privacy Notice | PAIA Policy | Terms of Use | Request for Access Forms | Personal Information Request Form | POPI Complaint Form |

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |

Jonathan Jawno

Chief Executive Officer

Qualification:

BCom (Hons)

Graduate Diploma Accounting (University of Cape Town)

CA(SA)

After completing his articles at Arthur Andersen, Jonathan co-founded Stratvest in 1995, together with Michael Mendelowitz. In 1997, African Bank acquired 50% of Stratvest, leading to the formation of Nisela Growth Investments. Jonathan assumed an executive role at African Bank Limited and held the position of joint CEO of Nisela Growth Investments until 2002. Jonathan went on to acquire and grow the group of companies that in 2007 became the foundation of Transaction Capital. Jonathan was appointed as an executive director of Transaction Capital in June 2010 and stepped into the role of Chief Executive Officer on 1 January 2024.

Sharon Wapnick

Independent Non-Executive Director

Qualification:

BA

LLB (University of the Witwatersrand)

Sharon is a practising attorney and one of the founding partners and a senior partner of the law firm Tugendhaft Wapnick Banchetti & Partners, which was formed in October 2004. She was admitted as an attorney in 1988. Sharon specialises in commercial litigation and has extensive experience in regulatory and property-related matters and in high-profile commercial and civil litigation, as well as arbitrations. Sharon currently serves as the non-executive chairman of Octodec Investments Limited, a real estate investment trust company listed on the JSE Limited, and is a non-executive director of City Property Administration Proprietary Limited. She was also a founding director of Dial Direct Insurance Company Limited.

Sahil Samjowan

Chief Financial Officer

Qualification:

BCOM (University of KZN)

Postgraduate Diploma in Accounting (University of KZN)

CA (SA)

Senior Executive Programme Africa (Harvard Business School)

Sahil Samjowan previously served as the chief financial officer of Nutun. He is a CA (SA) and completed his articles at PwC. Additionally, in 2018, he completed the Senior Executive Programme for Africa at Harvard Business School. Sahil has strong accounting, taxation and business acumen with a proven track record. Sahil joins Transaction Capital with 15 years’ of banking experience. Sahil was appointed as the Chief Financial Officer at Transaction Capital on 1 June 2023.

ESG World is a platform that gives the investment community easy access to our company’s ESG database in the areas of Environmental, Social, Governance and other related sustainability agendas that are referenced in the United Nations Sustainable Development Goals (SDGs), Task Force on Climate-Related Financial Disclosures (TCFD), Global Reporting Initiatives (GRI) standards and the Sustainability Accounting Standards Board (SASB), amongst other sustainability frameworks and standards. This platform is updated on a regular basis to communicate our latest ESG disclosures.

Sean Doherty

Chief Financial Officer

Qualification:

BAcc (Hons) (University of Johannesburg)

CA(SA), MBA (IE Business School)

AMP (Columbia Business School)

ACMA (UK)

Sean served his articles at Deloitte & Touche in Johannesburg and has more than 20 years’ experience in the financial services industry. Most recently, Sean held the position of COO and CFO of Standard Bank’s Investment Banking division. Sean was appointed as an executive director of the Transaction Capital board and CFO with effect from 1 June 2019.

Mark Herskovits

Chief Investment Officer

Qualification:

BBusSci (Finance)

Postgraduate Diploma in Accounting (University of Cape Town)

CA(SA)

CFA

Mark served his articles at Deloitte & Touche in Johannesburg. After staying on as a manager until 2001, he joined Rand Merchant Bank as a corporate bond investment analyst in the special projects international division. In 2007, Mark joined Transaction Capital to assist in the corporate activity required to establish the group. He joined the capital markets division in 2009 and led the team from June 2010, where he remained until his appointment in January 2014 as group CFO. In August 2016, Mark was appointed as executive director of capital management with primary responsibility for the group’s capital management strategy and activities, and in February 2020 was appointed as group chief investment officer. In this position, his responsibilities include capital management, oversight of the asset and liability committee, TCRS book buying and the group’s offshore investment strategy through Transaction Capital Global Finance.

Michael Mendelowitz

Executive Director

Qualification:

BCom (Hons)

Graduate Diploma Accounting (University of Cape Town)

CA(SA)

After completing his articles at Deloitte & Touche, Michael co-founded Stratvest in 1995, together with Jonathan Jawno. In 1997, African Bank acquired 50% of Stratvest, leading to the formation of Nisela Growth Investments. Michael assumed an executive role at African Bank Limited and held the position of joint CEO of Nisela Growth Investments until 2002. Michael went on to acquire and grow the group of companies that in 2007 became the foundation of Transaction Capital. Michael was appointed as an executive director in December 2011.

Roberto Rossi

Executive Director

Qualification:

BSc (MechEng) and Graduate Diploma (IndEng) (University of the Witwatersrand)

BProc (Unisa)

Roberto founded Miners Credit Guarantee in 1991 to provide credit card-type facilities to mineworkers. In 1998, Nisela Growth Investments (part of African Bank) acquired a 50% shareholding in Miners Credit Guarantee. Shortly thereafter, Roberto assumed an executive role at African Bank Limited and was subsequently responsible for establishing, acquiring and operating several of the businesses owned by African Bank. After selling his remaining shares in Miners Credit Guarantee to African Bank in 2003, Roberto partnered with Jonathan Jawno and Michael Mendelowitz to acquire and grow the group of companies that in 2007 became the foundation of Transaction Capital.

Christopher Seabrooke

Independent Non-Executive Director

Qualification:

BCom

BAcc (University of KwaZulu-Natal)

MBA (Wits Business School)

FCMA (UK)

Chris is a financier and investor with extensive experience in financial services, including credit-orientated and speciality finance assets, which enhances the board’s ability to provide strategic counsel. He is currently CEO of Sabvest Limited and a director of Metrofile Holdings Limited, and has served on the boards of over 25 listed companies over the years including Brait S.E., Datatec Limited, Massmart Holdings Limited and Net1 U.E.P.S. Technologies Inc. He is also a director of other unlisted companies locally and internationally. Chris is a former chairman of the South African State Theatre and former deputy chairman of the inaugural National Arts Council and the founding board of Business & Arts South Africa.

Buhle Hanise

Independent Non-Executive Director

Qualification:

BCom (University of Transkei)

BCom (Hons) (University of KwaZulu-Natal)

CA(SA)

After completing her articles with KPMG, Buhle held credit management positions at The Standard Bank of South Africa Limited, Nedbank Limited and most recently as a senior business rescue specialist at the Industrial Development Corporation (IDC). In January 2020, Buhle was appointed as chief financial officer of BAIC South Africa, a subsidiary of the IDC. She is a non-executive director of OUTsurance Holdings Limited and the South African Forestry Company SOC Limited. She is also president of African Women Chartered Accountants. In addition to her primary qualifications, Buhle holds advanced certificates in Business Rescue Practice from the Law Society of South Africa, and in Insolvency Law and Practice from the University of Johannesburg, as well as in Emerging Markets and Country Risk Analysis from Fordham University. She has completed the Development Finance Programme at the University of Stellenbosch Business School.

Suresh Kana

Lead Independent Non-Executive Director

Qualification:

BCom

BCompt (Hons)

MCom, PhD (Honorary) (University of the Witwatersrand)

CA(SA)

Suresh was admitted as a partner at PwC in 1986, and subsequently appointed as CEO and senior partner of PwC Africa. He currently chairs the Murray & Roberts Holdings Limited board and is lead independent director of the JSE Limited. Suresh also chairs the audit committee of the United Nations World Food Programme based in Rome and serves as a trustee of the IFRS Foundation based in London. Suresh is the deputy chair of the Integrated Reporting Committee of South Africa and the former chair of the King Committee on Corporate Governance. Suresh has previously served as board chair of the South African Institute of Chartered Accountants and deputy chair of the Independent Regulatory Board for Auditors. Past non executive directorships include Illovo Sugar Limited, Quilter plc and board chair of Imperial Holdings Limited.

Albertinah Kekana

Independent Non-Executive Director

Qualification:

BCom; Chartered Accountant (SA)

Post-Graduate Diploma in Accounting (University of Cape Town)

Advanced Management Programme

Harvard University (USA)

Albertinah has extensive asset management, investment banking, financial services and business leadership experience. She has held the position of CEO of Royal Bafokeng Holdings (Pty) Ltd since 1 November 2012. Prior to this, she was the chief operating officer of Public Investment Corporation SOC Limited and Director – Corporate Finance at UBS Group AG. Until recently, Albertinah served as a non-executive director of RMB Holdings Limited, and is currently a non-executive director of Rand Merchant Investment Holdings Limited and Development Bank of Southern Africa Limited.

Ian Kirk

Independent Non-Executive Director

Qualification:

CA(SA)

HDip BDP (Wits)

FCA (Ireland)

Ian was admitted as a partner at PwC in 1986 and has since held various leadership positions at executive and non-executive level, including at industry associations such as the South African Insurance Association and the Association of Savings and Investment South Africa. Ian served as CEO of Sanlam from 2015 to December 2020 and was a director on various subsidiary boards of the Sanlam Group, including Santam, Shriram Capital, AfroCentric and Sanlam Life. Prior to this, he served as CEO at Santam and Capital Alliance Holdings, and as deputy CEO of Liberty Group. Ian was appointed to the Presidential State Owned Enterprises Council in June 2020, which is mandated to reposition South Africa’s state-owned enterprises. Association of Savings and Investment South Africa, where he is the deputy chairman. Ian served as CEO of Sanlam from 2015 to December 2020 and was a director on various subsidiary boards of the Sanlam Group, including Santam, Shriram Capital, Afrocentric and Sanlam Life. Prior to this, he served as CEO at Santam and Capital Alliance Holdings, and as deputy-CEO of Liberty Group. Ian was appointed to the Presidential State owned Enterprise Council in June 2020, which is mandated to reposition South Africa’s state-owned enterprises.

Kuben Pillay

Independent Non-Executive Director

Qualification:

BA

LLB (University of the Witwatersrand)

MCJ (Howard School of Law)

Kuben held various executive positions within Primedia Limited from September 2002 to February 2014, including serving as the group chief executive officer (CEO) and thereafter as group executive chairman. From February 2014 to December 2016, he served in the capacity of non-executive chairman of Primedia Limited. An attorney by profession, Kuben was a managing financial partner at attorneys Cheadle Thompson and Haysom before joining Mineworker’s Investment Company Proprietary Limited in 1996 as a founding executive director, and later as the non-executive chairman of the Mineworker’s Investment Company. Kuben currently serves as the chairman of Sabvest Limited and Net1 UEPS Technologies, Inc. and as the lead independent director of the OUTsurance group of companies.

Diane Radley

Independent Non-Executive Director

Qualification:

BCom (Rhodes)

BCom (Hons) (Unisa)

CA(SA)

MBA (Wits Business School)

AMP (Harvard Business School)

Diane was admitted as a partner at PwC in 1999, where she led the Transaction Services Group that advised on local and international listings and corporate transactions. In 2001, she joined Allied Electronics Corporation Limited as its chief financial officer (CFO) and was also appointed as a non-executive director at Allied Technologies Limited, Bytes Technology Group Limited, Omnia Holdings Limited and Women Investment Portfolio Holdings Limited. In 2008, Diane served as Old Mutual South Africa’s group finance director and in 2010 she was appointed as Old Mutual Investment Group’s CEO until the end of 2016. Diane is currently a non-executive director of JSE-listed Murray & Roberts Holdings Limited, Redefine Properties Limited and Australian Securities Exchange-listed Base Resources Limited and London Securities Exchange-listed Network International Holdings plc. Diane serves as a trustee on the DG Murray Trust, a public innovator committed to developing South Africa’s potential through strategic investment.